1) The first and most common Sedona buyer mistakes is waiting for the market to crash before you purchase. Just to give perspective on this, in 2021 Sedona we had approximately 30% appreciation. In the market crash around 2008, Sedona real estate reduced in value by approx 40%. So right now it takes just over a year to gain that value of the last crash. I’ve been told by various buyers over the last 10 years that they’re just waiting for the market to crash before they’re going to purchase.

These buyers would have probably tripled the value of their home over the last 10 years. In the last three years, most of my clients have doubled their home value. For short-term rental investors, there’s also the cash flow element. Along with the appreciation, they receive an average of 25% cash on cash returns, per year.

2) The second most common buyer mistake is trying to buy the least expensive single-family home on the market. When you purchase the least expensive property on the market, it’s actually costing most buyers quite a bit more than they think it is- as the least expensive homes have the most buyer competition. So purchase price is going to be higher than you want it to be when everything is said and done; Quite a bit higher than asking. Also, for cash flow investors, the “sweet spot” for return on investment (ROI) is actually closer to about $900,000 to $1,500,000. This is where we’re finding the best cash flow return on investment opportunities right now. The lower-cost properties, are not giving the returns that you would hope for.

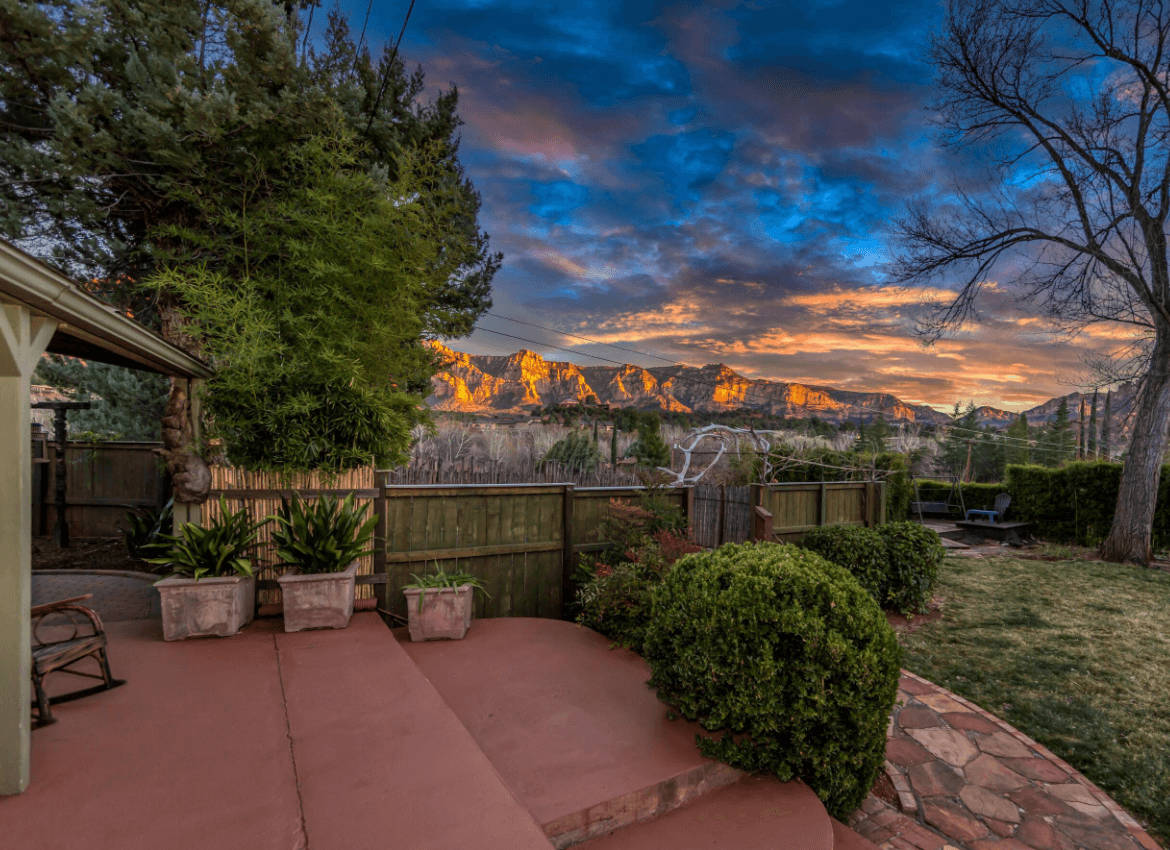

3) The third most common Sedona buyer mistake is only offering on the homes with the best views. If the home will be your primary residence or a regularly used 2nd home, then absolutely be picky. Wait for a home you will love using. For investors that want something to add to their portfolio, choose what’s going to yield the best return on investment, not just what has the best views. Many times views don’t mean better ROI. Views WILL boost your cash flow and home value. BUT, there are a lot of really great cash flow investment opportunities out there that have no or minimal views.

There are other features in Sedona that are very desirable to tenants. Reach out to us, ask us, and I’ll be happy to go over a list with you of what’s important when you’re looking for short-term rentals in order to secure your home value and resale, as well as attract a strong renter base.